I've been unsuccessfully scheming a path to self-employment, semi-retirement, and joblessness for a long time. But recently I've legitimately made progress, mainly on the back of the NFT market.

I didn't design this quest to solely focus on NFTs, but since I seem to have stumbled into an emerging market (bubble?), I figure I should at least give some airtime to what started it for me.

In late December I was clumsily thumbing my way through the bundles of newsletters that pile up in my inbox. I hate notifications, so I find a way to either read or delete all my newsletters, there is really no in-between.

It just so happened that on December 28th, I actually read this newsletter from the desk of Fred Wilson.

The piece was only a few paragraphs about NBA Top Shot, but the keywords - NBA, Crypto, Cash - were all triggers for me.

I created an account, and bought a few packs. I did not buy ENOUGH packs.

I messaged a few friends and then mainly logged off. I don't even know if I looked at the marketplace at all.

Then a few weeks later I logged back in, and famously chose a Popeyes chicken sandwich over the Deck the Hoops packs. Yeah, remember this from The First Attempt:NFTs ?

Determined to at least give the packs a good look, I booted up the site while I was in line at a Popeyes (god those chicken sandwiches are so good). In between ordering my sandwich and the first drive-thru window, I moved through the purchasing process. I selected quantity two, hit buy, headed to the payment page and then for reasons I can’t explain - exited. For some reason, in the process of buying a $6 sandwich, a $230 pack of digital trading cards felt too rich. At the time, I didn’t think too much about it and I really enjoyed my sandwich.

Haha. What a tale. Well, anyway, a few days after that, Jonathan Bales strapped a rocket to Top Shot with his $35,000 Ja Morant purchase and his accompanying bull thesis. Since I just watched Toy Story again, I felt this was an accurate representation of the article.

More market participants flooded in, more money flowed in, and the market pumped. True believers, collectors, speculators, were (and still are) present and accounted for.

While I had been a Top Shot participant prior to the Bales article, I must say, seeing smart folks around me buy-in was a strong catalyst to paying more attention. So I did something that I historically have shied from. I gained some conviction.

I started adding equity in bigger, more rare moments, and I built a considerable position. My credit card statement was full of payments to Dapper1 and as the days passed, my initial $5,000 investment and account valuation grew. And then it grew, and grew some more, and for much of this weekend hovered above $100,000.

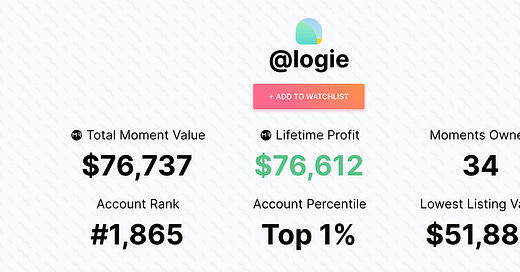

Despite some sharp downward action early this week, as of writing, my account valuation stands as indicated below, per MomentRanks.com.

If only it was all roses though….

While my investment thesis has quickly evolved to - rares, stars, and rookies - my early buying and selling patterns carry A LOT of mistakes.

Here's just a few fun ones:

I passed on a Nikola Jokic Cosmic Handles moment for $5,000. It's low ask is now $67,999 and it has a recent sale of $38,000.

I got locked out of my account for KYC and had to watch a LeBron James Rare moment slip away for $3,000. It's low ask now sits north of $16,000.

I sold an obnoxious amount of moments for $1. The cheapest moment on site is now $15.

Before Zion, KD, and LeBron went limited edition in series two, I shipped them off, trying to focus on more rare moments. I thought I was winning gaining around $75 for the five moments. Those same moments total nearly $5,000 today.

I let the "withdrawal issues" FUD get to me, selling off a sizable portion of my collection prior to the most recent run up. I refuse to show the chart or do the math.

As painful as it is to recall some of these actions, undoubtedly there are many more mistakes to be made. But, so far, the good has far outweighed the bad.

Aside from my lack of grit, a profound focus on investing, as opposed to leveling up my cash position has always stood in the way of me leaping to joblessness. Entering 2021, I knew that building my cash reserves would be necessary for two reasons, liquidity and anxiety reduction.

As of now, a lot of my gains are still unrealized and can’t be fully counted towards my pursuit. But, nevertheless, my Top Shot experience has provided a shred of hope that joblessness is like those other objects in your side mirror....closer than it appears.

Dapper Labs is the company behind NBA Top Shot and Crypto Kitties